Diving into the realm of risk management, this introduction delves into the crucial aspects of identifying, assessing, and mitigating risks in various industries. From financial uncertainties to operational challenges, risk management plays a vital role in shaping organizational strategies and decision-making processes.

Let's embark on a journey to uncover the intricacies of managing risks effectively.

Definition of Risk Management

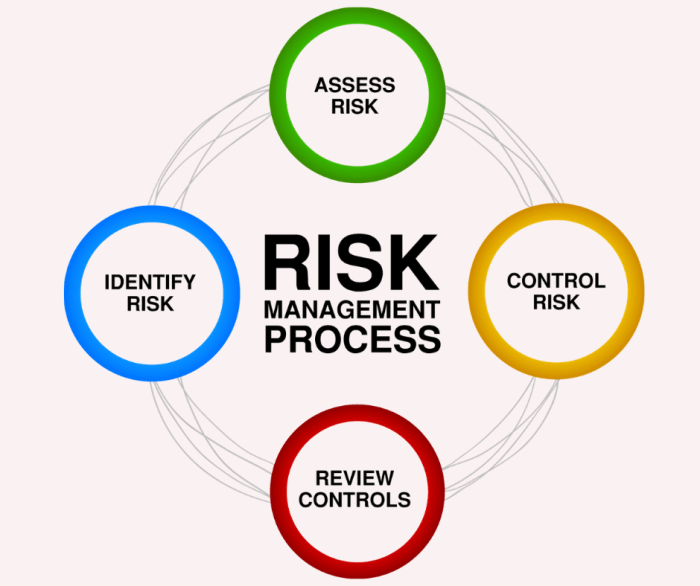

Risk management is the process of identifying, assessing, and prioritizing risks followed by coordinated and economical application of resources to minimize, monitor, and control the impact of these risks. It is crucial for organizations across various industries as it helps in anticipating potential threats and opportunities, thereby enabling them to make informed decisions to achieve their objectives effectively.

Importance of Risk Management

Risk management plays a vital role in ensuring the sustainability and growth of businesses by mitigating potential risks that could hinder their operations. By identifying and addressing risks proactively, organizations can protect their assets, reputation, and financial stability.

- Financial Risks: Organizations face financial risks such as market fluctuations, credit risks, and liquidity risks that can impact their profitability and cash flow.

- Operational Risks: Operational risks include internal processes, systems failures, and human errors that can disrupt business operations and affect productivity.

- Compliance Risks: Compliance risks arise from non-compliance with laws and regulations, leading to legal penalties and reputational damage.

Risk management aims to minimize the potential negative impacts of risks while maximizing opportunities for growth and innovation.

Objectives of Risk Management

Risk management aims to achieve the following objectives:

- Identifying Risks: By assessing and analyzing potential risks, organizations can identify threats and opportunities that may affect their objectives.

- Evaluating Risks: Risk management helps in evaluating the likelihood and impact of risks to prioritize and allocate resources effectively.

- Controlling Risks: Implementing risk mitigation strategies and controls to minimize the impact of risks on the organization's operations and performance.

- Decision-making: Risk management provides valuable insights and data-driven information to support effective decision-making processes.

Types of Risks

Risk management involves identifying and addressing various types of risks that can impact a business. These risks can be categorized into different categories based on their nature and impact on operations. Let's explore some common types of risks below.

Financial Risks

Financial risks pertain to potential losses due to market fluctuations, credit issues, liquidity problems, or other financial factors that can affect the organization's financial health. These risks can impact cash flow, profitability, and overall financial stability.

Operational Risks

Operational risks are related to internal processes, systems, and people within the organization. These risks include failures in processes, human errors, technology failures, or supply chain disruptions that can hinder the organization's ability to function efficiently.

Strategic Risks

Strategic risks are associated with decisions made by management that may lead to missed opportunities, competitive threats, or ineffective strategic planning. These risks can impact the organization's long-term goals and overall competitiveness in the market.

Compliance Risks

Compliance risks arise from the failure to comply with laws, regulations, or industry standards. Non-compliance can result in fines, legal actions, reputational damage, and other consequences that can harm the organization's operations and standing in the industry.

Internal vs. External Risks

Internal risks originate from within the organization and are under its control, such as operational or strategic risks. External risks, on the other hand, come from external sources like economic conditions, regulatory changes, natural disasters, or political instability, which the organization has limited control over.

Categorization of Risks

Risks can also be categorized based on their impact on business operations, such as financial risks, operational risks, strategic risks, and compliance risks. By understanding the different types of risks and their categorization, organizations can develop effective risk management strategies to mitigate potential threats and safeguard their operations.

Risk Assessment Methods

Risk assessment methods are crucial in identifying and analyzing potential risks that may impact a business or project. By utilizing various approaches, organizations can effectively prioritize and manage risks to ensure successful outcomes. Let's explore different methods used for assessing risks, including qualitative and quantitative approaches, along with the process and tools involved.

Qualitative Risk Assessment

Qualitative risk assessment involves the subjective analysis of risks based on their impact and likelihood. This method does not assign numerical values but rather uses descriptive terms such as low, medium, or high to evaluate risks. It allows for a quick and simple evaluation of risks without the need for complex calculations.

- Expert Judgment: Involves gathering insights from individuals with expertise in the field to identify and assess risks.

- SWOT Analysis: Analyzes the Strengths, Weaknesses, Opportunities, and Threats related to a project or business to determine potential risks.

- Checklists: Utilizes predefined lists of potential risks to systematically identify and evaluate threats.

Quantitative Risk Assessment

Quantitative risk assessment involves the numerical analysis of risks using data and mathematical models. This method assigns values to risks, such as probabilities and monetary impacts, to calculate risk exposure more precisely. It provides a quantitative measure of risk that can help in making informed decisions.

- Monte Carlo Simulation: Utilizes random variables to model different scenarios and assess the likelihood of various outcomes.

- Decision Trees: Represents decisions and their potential outcomes in a tree-like structure to evaluate risks and make optimal choices.

- Sensitivity Analysis: Examines how changes in variables or assumptions impact the overall risk assessment results.

Risk assessment is a vital step in the risk management process as it enables organizations to proactively identify and address potential threats

Risk Mitigation Strategies

Risk mitigation strategies are crucial for organizations to minimize the impact of potential risks on their operations. These strategies involve various approaches such as risk avoidance, risk reduction, risk transfer, and risk acceptance. By understanding and implementing these strategies effectively, organizations can proactively manage and mitigate risks in a more efficient manner.

Risk Avoidance

Risk avoidance is the strategy of completely avoiding activities or situations that could lead to potential risks. This approach is suitable for risks that pose a high level of threat and where the cost of prevention is lower than the potential impact.

By opting to not engage in risky activities or projects, organizations can eliminate the possibility of facing those risks altogether.

Risk Reduction

Risk reduction focuses on minimizing the likelihood or impact of risks through proactive measures. This strategy involves implementing control measures, safety protocols, redundancies, and other preventive actions to reduce the probability of risks occurring. By identifying potential vulnerabilities and addressing them proactively, organizations can significantly lower the overall risk exposure.

Risk Transfer

Risk transfer involves shifting the financial burden of potential risks to another party, such as insurance companies or contractual agreements. This strategy allows organizations to transfer the responsibility of managing certain risks to external entities, thereby reducing their financial exposure in case of adverse events.

By transferring risks, organizations can protect their assets and mitigate potential losses.

Risk Acceptance

Risk acceptance is the strategy of acknowledging the existence of risks and accepting them as part of the business operations. This approach is suitable for risks with low impact or likelihood, where the cost of mitigation outweighs the potential benefits.

By accepting certain risks, organizations can focus their resources on managing more critical risks and opportunities, rather than investing in unnecessary risk mitigation measures.

Risk Appetite and its Influence

Risk appetite refers to the level of risk that an organization is willing to take in pursuit of its objectives. It plays a crucial role in determining the extent to which risk mitigation strategies are implemented. Organizations with a high risk appetite may be more inclined to accept or transfer risks, while those with a low risk appetite may focus on avoidance or reduction strategies.

Understanding and aligning risk appetite with risk mitigation decisions is essential for effective risk management.

Examples of Successful Risk Mitigation Strategies

- Company XYZ implemented a comprehensive risk reduction strategy by enhancing cybersecurity measures, conducting regular risk assessments, and investing in employee training. This proactive approach helped prevent data breaches and minimize the impact of potential cyber threats.

- Organization ABC successfully transferred financial risks associated with fluctuating exchange rates by entering into hedging contracts with financial institutions. This risk transfer strategy protected the organization from currency fluctuations and ensured stable financial performance.

Risk Monitoring and Control

Risk monitoring and control play a crucial role in ensuring the success of a project or business operation. By continuously monitoring risks and implementing control measures, organizations can proactively address potential threats and minimize their impact.

Key Performance Indicators (KPIs) for Risk Control

Effective risk management relies on the use of key performance indicators (KPIs) to track and control risks. Some common KPIs used in risk management include:

- Risk Exposure: Measuring the level of risk exposure helps in understanding the potential impact of risks on the project or operation.

- Risk Response Time: Monitoring how quickly risks are identified and responded to can help in minimizing their consequences.

- Risk Mitigation Effectiveness: Evaluating the effectiveness of risk mitigation strategies helps in determining their success in reducing the impact of risks.

- Cost of Risk Management: Tracking the cost associated with managing risks can help in optimizing resources and budget allocation.

Role of Risk Control Measures

Risk control measures are essential in minimizing the impact of potential threats on a project or business operation. These measures involve:

- Implementing Preventive Actions: Taking proactive steps to prevent risks from materializing can help in avoiding potential losses.

- Establishing Contingency Plans: Developing contingency plans allows organizations to respond effectively to unforeseen events or risks.

- Regular Monitoring and Reporting: Continuously monitoring risks and reporting on their status ensures that timely actions can be taken to address emerging threats.

- Conducting Risk Reviews: Regularly reviewing and updating risk management strategies helps in adapting to changing circumstances and new risks.

Final Summary

In conclusion, risk management is not just about avoiding potential pitfalls, but also about seizing opportunities for growth amidst uncertainties. By embracing diverse risk mitigation strategies and adopting proactive risk assessment methods, organizations can navigate through turbulent times with resilience and foresight.

Stay vigilant, stay informed, and stay ahead in the realm of risk management.

Expert Answers

What are the benefits of risk management?

Risk management helps organizations anticipate potential threats, seize opportunities, make informed decisions, and enhance overall resilience.

How can risks be categorized based on their nature?

Risks can be categorized as financial risks, operational risks, strategic risks, and compliance risks based on their nature and impact on business operations.

What is the importance of continuous risk monitoring?

Continuous risk monitoring ensures that organizations stay proactive in identifying potential threats, allowing them to take timely actions to mitigate risks.

How does risk appetite influence risk mitigation decisions?

Risk appetite defines an organization's willingness to take risks and influences the strategies chosen for risk mitigation, shaping the overall risk management approach.